ROMANIA’S NEW AUSTERITY PLAN: HOW HIGHER TAXES AND SPENDING CUTS COULD RESHAPE TRADE AND INVESTMENT

THE DEFICIT THAT FORCED BUCHAREST’S HAND

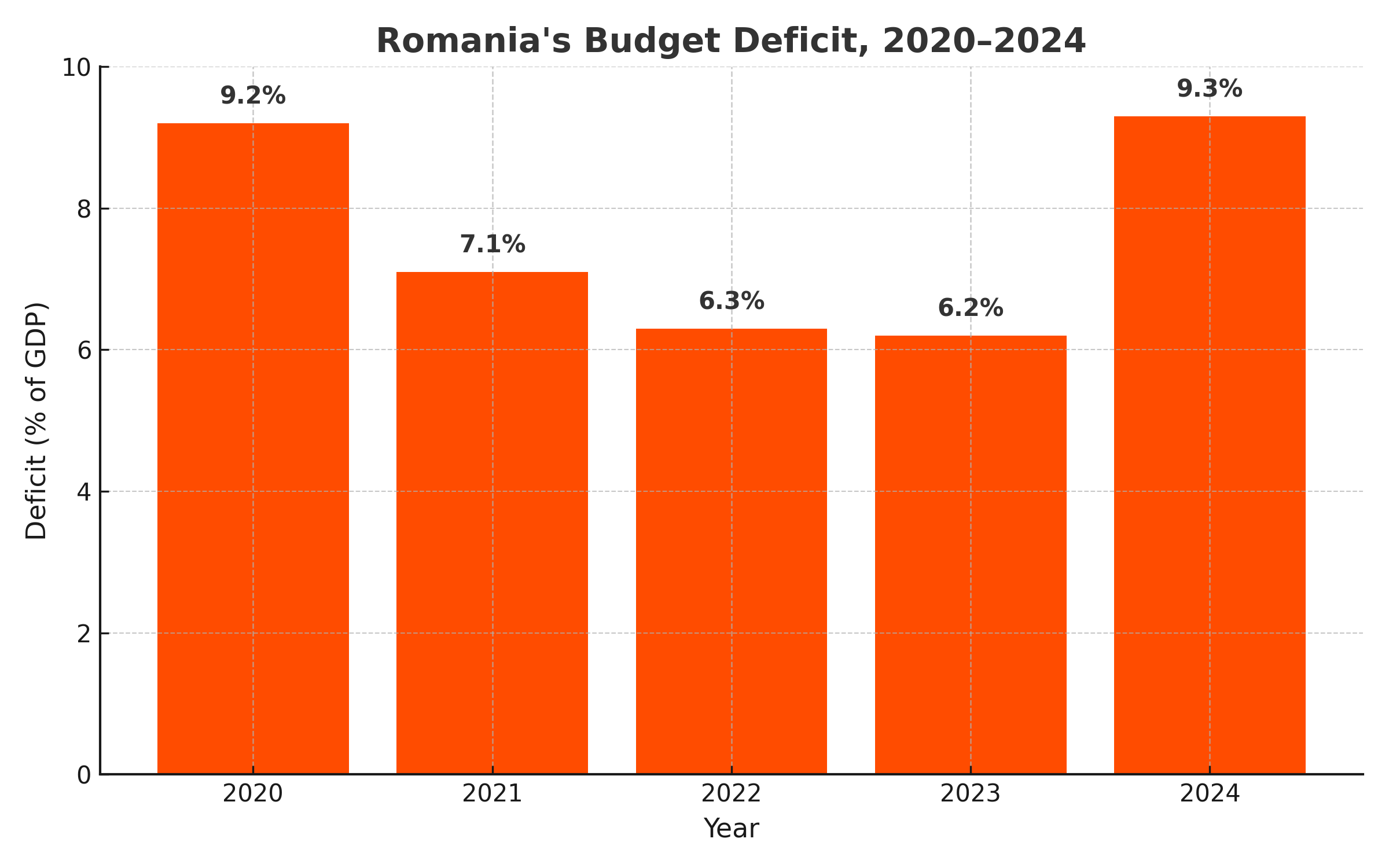

Romania closed 2024 with a budget deficit of 9.3 percent of GDP – the worst in the European Union and triple Brussels’ 3 percent ceiling. Markets took notice: yields on Romanian 10-year bonds rose nearly 130 basis points between January and May, and Fitch warned that a further slide could push the sovereign below investment-grade. For Prime Minister Ilie Bolojan, installed after last year’s snap election, avoiding a credit-rating downgrade became priority number one.

On 2 July 2025 the government unveiled a sweeping fiscal package. Key moves, effective 1 August:

the standard VAT rate will rise from 19 percent to 21 percent;

reduced VAT on food, medicines and books climbs from 9 percent to 11 percent;

excise on petrol and diesel increases by 0.10 lei per litre;

public-sector wages and pensions are frozen through 2026;

a temporary 2 percent “solidarity” levy hits bank and energy profits.

Authorities hope these measures will trim the 2025 deficit to 7.5 percent of GDP and below 6 percent by 2026.

WHAT THE NUMBERS TELL US

Romania managed to narrow its gap after the pandemic but never brought it under 6 percent. Then came a fresh spending surge in 2024. The chart shows the path:

The spike back to 9 percent shocked Brussels, putting almost €29 billion in NextGenerationEU recovery funds at risk. EU disbursements are tied to credible fiscal correction.

HOW BUSINESSES WILL FEEL THE SQUEEZE

Higher VAT means immediate price adjustments. Consumer-facing firms – food retailers, pharma distributors, e-commerce platforms – must update pricing systems in under a month. Romania’s Competition Council has warned against opportunistic mark-ups; compliance departments should prepare documentation to justify any price changes.

Fuel excise feeds directly into freight rates. With Romania a trucking hub between Western Europe and the Black Sea, logistics operators expect transport costs to climb 2–3 percent, squeezing margins in agriculture and light manufacturing exports.

Public-sector wage freeze dampens domestic demand: the government employs roughly 1.3 million people (about 15 percent of Romania’s labour force). Consumer-goods producers should brace for slower volume growth through 2026.

WILL FOREIGN INVESTORS PULL BACK?

Romania’s main selling points remain: 16 percent flat corporate tax, EU single-market access, and labour costs roughly 40 percent below the bloc average. But two risk factors now weigh heavier on board-room debates:

1. Policy fatigue. The speed and size of new tax hikes signal that further emergency measures are possible. Corporates planning cap-ex (automotive, shared services, renewables) will demand stronger stabilisation clauses.

2. Rating overhang. A downgrade to “BB+” would raise sovereign spreads and banks’ cost of capital, in turn lifting local borrowing rates.

That said, not all capital will flee. EU co-financed infrastructure projects – rail upgrades, digital networks, solar parks – still benefit from grant funding covering up to 50 percent of costs. Moreover, Bolojan’s office has promised to streamline EU-fund absorption, a long-standing bottleneck that could unlock €10 billion in 2025-26 construction contracts.

TRADE TIES: WINNERS AND WORRIERS

Export-oriented manufacturers (electronics, auto parts, apparel) suffer mainly through energy and logistics cost pass-through. But importers of higher-value consumer goods could see relative gains as domestic spending shifts toward price-sensitive staples, pushing wealthier households to keep shopping online for niche foreign brands.

Neighbouring Bulgaria and Hungary hope to capitalise. Both governments moved quickly on social media, touting stable 20 percent VAT and subsidies for greenfield plants. Site-selection advisers confirm “more Romanian enquiries than usual” for alternative warehousing across the border.

NEAR-TERM WATCH-POINTS

• August–September 2025: Parliament votes the package. Several opposition parties pledged street protests and constitutional challenges. Any delay risks missing EU deficit milestones.

• November 2025: Moody’s scheduled review. A one-notch cut would still keep Romania investment-grade but add roughly €500 million in annual debt-service costs.

• January 2026: Public-sector unions plan wage-freeze strikes if inflation stays above 6 percent. Disruption at customs and rail hubs would hit exporters first.

PRACTICAL STEPS FOR COMPANIES

1. Model new VAT burdens across product lines; update ERP systems by 1 August.

2. Hedge RON exposure. Fiscal tightening could slow growth and weaken the leu; consider cost-plus contracts or forward cover for imports.

3. Engage with EU-fund units to lock in grants before further fiscal turbulence.

4. Monitor credit ratings and bank funding costs; renegotiate loan covenants early if leverage ratios risk breach under higher interest expense.

BOTTOM LINE

Romania’s austerity pivot is designed to save its investment-grade status and keep EU money flowing, but it comes at a cost: higher taxes, slower spending, and political unrest. Companies that rely on Romania as a low-cost, stable gateway to the EU should build in pricing flexibility and contingency funding—because while the fiscal math looks tough, the politics may prove tougher still.